REGular Blog: NCUA May Board Meeting, Trends and Takeaways

The NCUA held their May Board meeting on Wednesday, May 22. This was a slight departure from their usual schedule of Board meetings being on the third Thursday of every month. They have also cancelled the June meeting. After what is expected to be a packed agenda at the July meeting, we will see if they eventually get back to a regular schedule. At Wednesday's meeting, the Board received a briefing on the Share Insurance Fund, which is done on a quarterly basis. This was the only agenda item. Chairman Harper is out on medical leave for back surgery, so Vice Chairman Hauptman and Board Member Otsuka conducted the meeting. Here are some trends and takeaways from the meeting.

Both Board members shared their thoughts on the NCUA collecting overdraft and NSF fee data

Before the NCUSIF briefing, Vice Chairman Hauptman spoke about the NCUA's recent decision to require large credit unions to report overdraft and NSF fee income. He noted that at every event he goes to, he hears about this decision from credit unions. Side note: I can confirm this, as I spoke with the Vice Chairman at both GAC and at the League Annual Meeting about the reporting requirement. The Vice Chairman stated that he found out about the requirement in January, and he proposed several alternatives, such as reporting the data in the aggregate, all of which were rejected. He noted that in many cases, government agencies charge higher fees than anything labeled a "junk fee" in the private sector. He stressed that when people who don't have enough money in their account to cover charges there are only bad options. However, consumers would rather pay an overdraft and have the transaction go through than have it declined. He closed his remarks noting that the NCUA should not have interest rate risk as their top supervisory priority while at the same time driving credit unions away from non-interest income.

Board Member Otsuka also spoke about overdraft fees in her opening remarks. She highlighted her desire for credit unions to serve more people of modest means. She noted that she has heard from many consumers over the years about overdraft practices and excessive overdraft fees. She stated that there needs to be some recognition that the NCUA has a responsibility to ensure that overdraft is being offered in a responsible manner. She stressed that we should not be pre-judging anything before the data can be responsibly analyzed. She added that in the financial services industry many financial institutions have started to get rid of overdraft fees, and that market forces are in play already.

While the number of CAMELS Code 4/5 credit unions stayed the same and the number of CAMELS Code 3 credit unions declined, total assets at these credit unions continues to rise.

One of the most interesting elements of the share insurance fund quarterly briefing is the snapshot of CAMELS Code 3, 4, and 5 credit unions, since this is pretty much the only public data on CAMELS ratings for credit unions. By raw total numbers - the data is positive. At the end of Q1 there were 125 CAMELS Code 4/5 credit unions - unchanged from Q4 of 2023. There were 760 CAMELS Code 3 credit unions at the end of Q1 - down from 776 at the end of 2023.

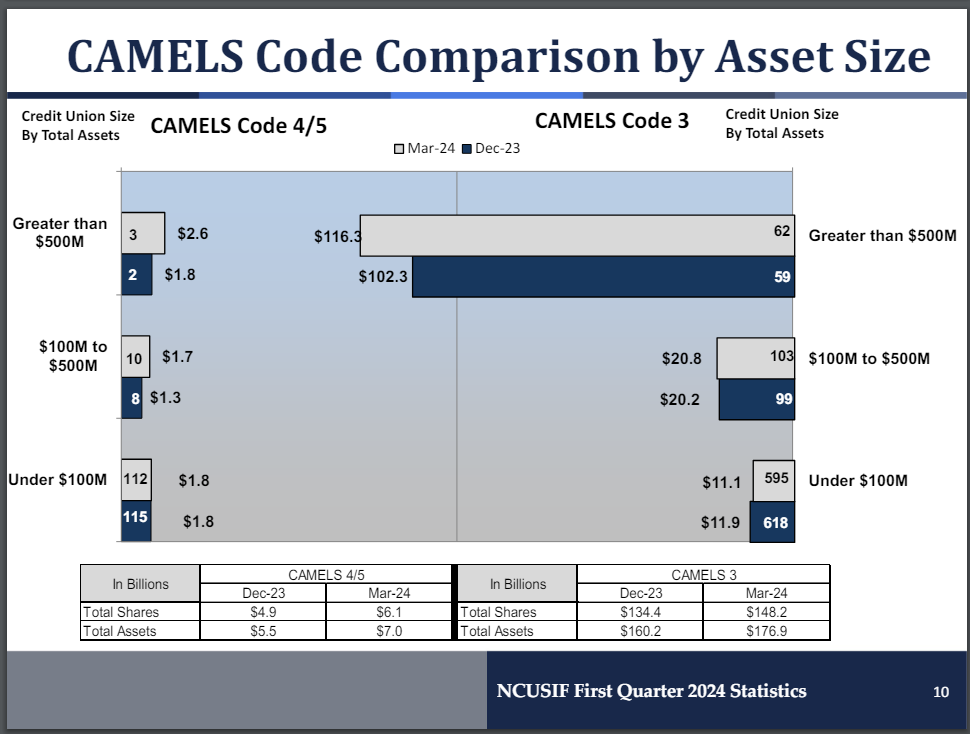

However, the number of larger credit unions with these CAMELS codes is growing, while the number of smaller credit unions with these CAMELS codes is shrinking. At the end of 2023 there were 59 CAMELS Code 3 credit unions over $500 million in assets, with combined total assets of $102.3 billion. At the end of Q1 2024 there were 62 CAMELS Code 3 credit unions over $500 million in assets, with a combined $116.3 billion in total assets. This trend can be seen in the chart below - the bar graphs at the top are getting longer while below they are getting shorter.

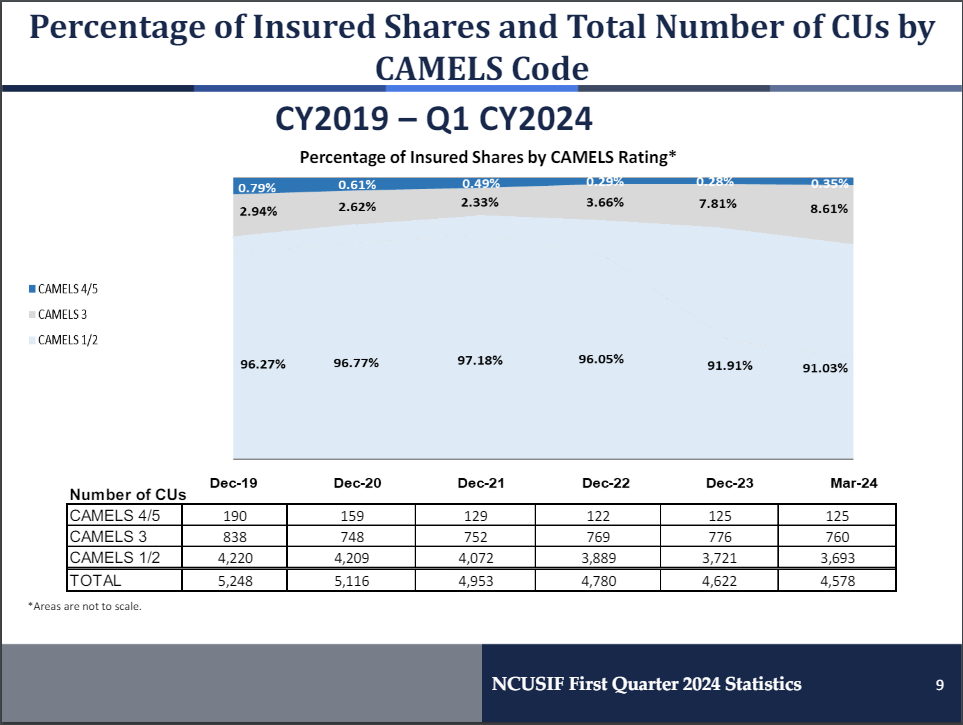

This impact of this is there are more total assets at CAMELS Code 3 and CAMELS Code 4/5 credit unions, a multi-year trend that continued. At the end of Q1, 8.61% of insured shares were held at a CAMELS Code 3 credit union and 0.35% at a CAMELS Code 4/5 credit union, up from 7.81% and 0.28%, respectively, at the end of 2023. This is illustrated in the chart below, which as noted, is not to scale:

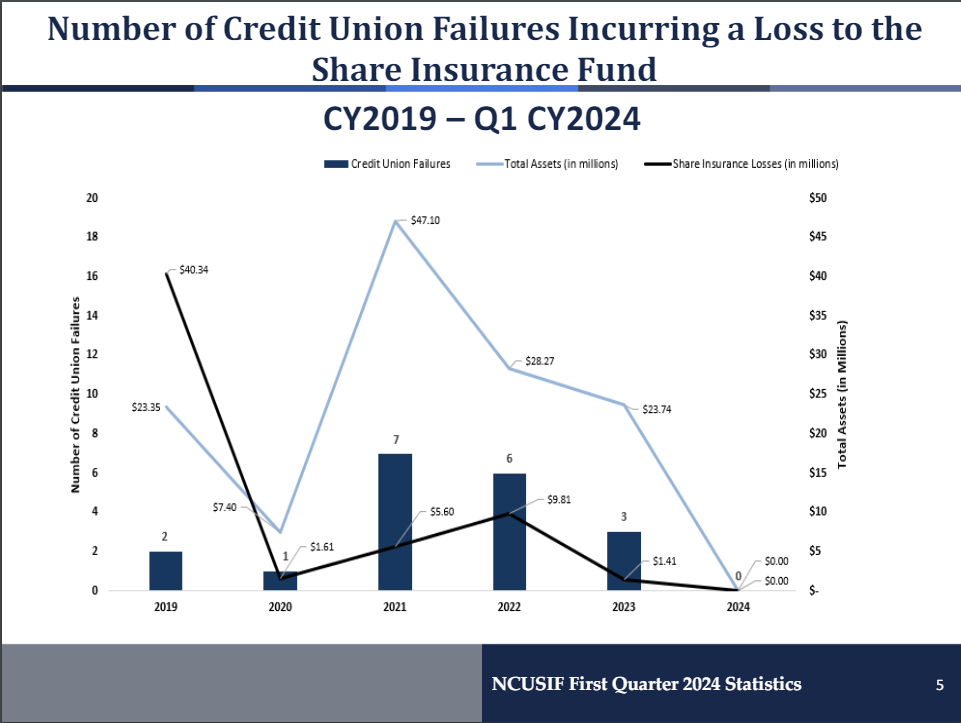

Credit union failures resulting in losses to the share insurance fund remains very low

The Quarterly Share Insurance Briefing contains data on any credit union failures that incurred a loss to the NCUSIF. Because this was the first quarter briefing, we expected a low number, and we got it, with the report showing no credit union failures in Q1. The number of credit union failures resulting in a loss to the share insurance fund, the total assets of those credit unions, and the share insurance losses have all been in decline in recent years. This is certainly a positive trend for the industry, and something we talked about with lawmakers and others in the wake of last year's bank failures - just how many of credit union deposits are insured, with many credit unions having 100% of their deposits covered by the NCUSIF.

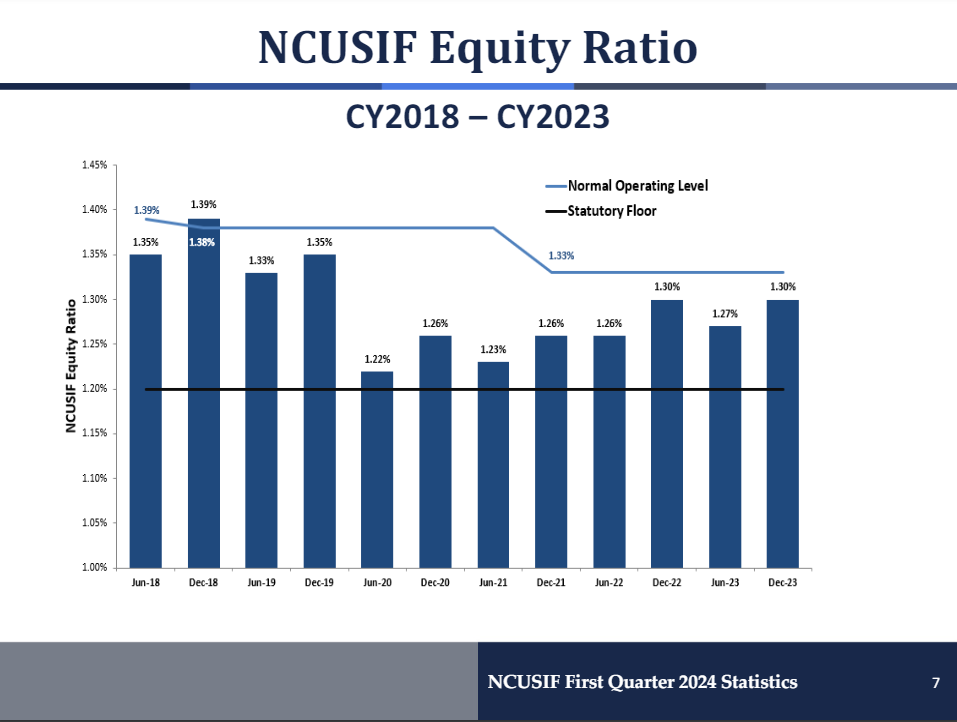

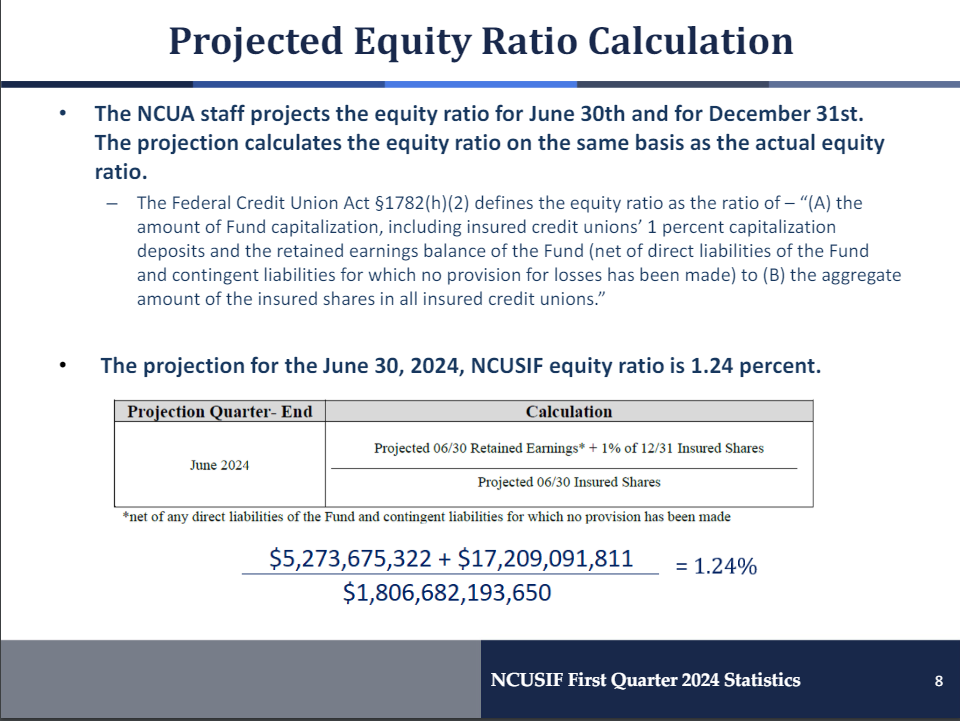

The estimated NCUSIF equity ratio for June 30th, 2024 is 1.24%

The NCUSIF Equity ratio is produced only twice a year, in December and June, so we did not get any data on that in this briefing. However, the NCUA did provide a projection that they estimate the June 2024 equity ratio will be 1.24%. This would be a decline from the 1.30% level at the end of 2023. The June number is historically lower than the December number.

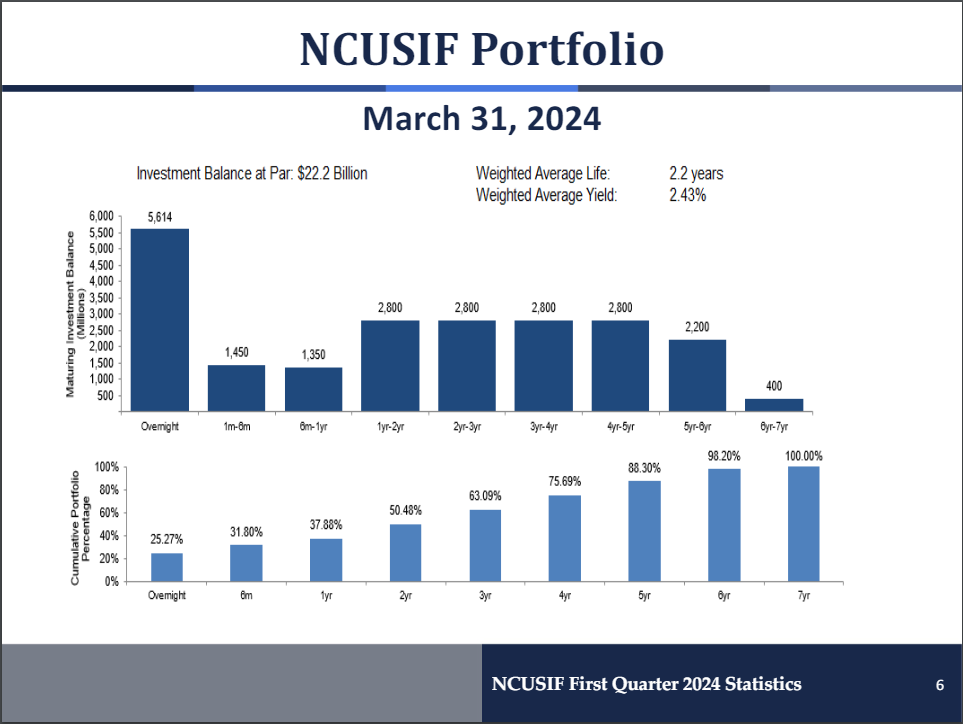

The NCUA is re-investing maturing bonds into its ladder, not just into overnights

Since 2022 the NCUA has been building its position of overnight investments, to the point where it now holds over $5.6 billion in overnight investments, representing 25.27% of its total investment portfolio. When asked about how the agency is preparing for possible interest rate cuts by the Fed, the NCUA staff member presenting the update stated that in the first quarter of 2024, the NCUA's investment committee reinvested all maturities back into the treasury ladder, noting that they do not try to time the market and the purchase of longer-term investments adds earning stability to the portfolio.

I always look forward to the Quarterly Share Insurance Briefing, as it provides some snapshots into the health of the NCUSIF and the credit union industry. The NCUA's next Board meeting is scheduled for Thursday, July 18, 2024.

- Share on Facebook: REGular Blog: NCUA May Board Meeting, Trends and Takeaways

- Share on Twitter: REGular Blog: NCUA May Board Meeting, Trends and Takeaways

- Share on LinkedIn: REGular Blog: NCUA May Board Meeting, Trends and Takeaways

- Share on Pinterest: REGular Blog: NCUA May Board Meeting, Trends and Takeaways

« Return to "News" Go to main navigation